One thing you have to realize in sales is that Nobody wants to buy what your service. Instead, people want to solve their problem. So the questions isn't what you are offering, instead it's what does a self directing participant need and is that what you offer?

I've spoken to a lot of self-directing participants (and more precisely I've mostly spoken to parents of self-directing disability services participants). Putting ourselves in their shoes, they've taken on the responsibility of literally running a business to provide services for their loved one. It's a big and hard job. What they need is a partner who will make it easy to get their bills paid. But more specifically they need the following:

- An immediate answer to the question "Where does my budget stand?"

- Ease of submitting expenses

- To know at a glance that their expenses have been approved.

They most likely have another full time job in addition to self-direction, so it's likely that they are doing their FMS work at night or on the weekend. They're going to shop for the FMS that makes their "Self-Direction Job" the easiest.

Self-Directing Participants Want a Great App That Makes Their Life Easier

When someone signs up for self-direction, they’re not just taking on the role of employer for their service workers—they’re also becoming their own mini CFO. They’re expected to manage a budget, handle time and attendance, submit expenses, and keep things compliant with state rules.

That’s a lot to put on someone. The easier you make it, the better.

And for most people today, “easy” means a good app. Not a paper form, not a PDF, and definitely not a phone call during business hours. If your app lets them handle the essentials quickly and confidently, you’re in the lead.

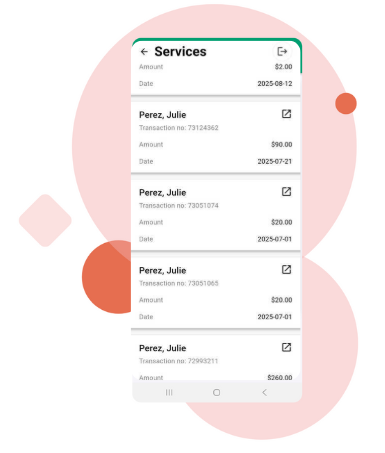

The image on the right shows them exactly where they stand. They can see the following:

- Authorized budget: In most programs, this is called the "Auth." In California, it's the POS

- Timeline - how much more time do I have to use this budget

- Spent so far: How much of this budget is spent so far?

- Remaining Budget: How much do I still have to spend

- Dollars and Hours or Units: In a lot of cases, the dollars translate into Caregiver or Direct Service Provider (DSP) Hours (or Units). So the app shows both Dollars and Hours/Units.

- Color Coding: If I see red, I've overspent my budget (but maybe that's ok). If I see green, I've underspent so far (but maybe that's bad)

- Drill Down: If you touch/click on the Auth/POS you see the visits or submitted expense history.

- App or Web: All of this can be done on iPhone, Android, PC or Mac

Submitting an Expense Should Take Less Than a Minute

When participants pay for a service out-of-pocket—say, a transportation cost or a piece of approved equipment—they want to be able to snap a photo of the receipt, choose the right category, and hit submit.

That’s it. No complicated menus. No wondering if they filled it out right. Just upload and done.

Again, it runs on iPhone, Android, PC or Mac. On phones you can take a picture of the receipt or upload it.

Again, it runs on iPhone, Android, PC or Mac. On phones you can take a picture of the receipt or upload it.

Budget Tracking Should Be Instantly Clear

Every participant has a budget cap, and most want to stretch their dollars as far as possible. That means they need to know three things at a glance:

This shouldn’t require a spreadsheet. It should be visual, current, and broken down into useful categories like wages, mileage, supplies, and more.

Visit History Should Be Easy to Access

Participants want to know when their workers clocked in and out, what visits have been approved, and whether timesheets are lined up for payment. If a visit wasn’t captured properly, they want to catch it early—before it becomes a problem.

This kind of visibility builds trust in your process. It also saves your support team from having to answer the same questions over and over.

Review past visits with full detail and status.

What this really means is: your app is your agency.

If it’s clunky or confusing, you’re going to lose people. If it’s clear and reliable, you’ll earn their loyalty—and maybe even word-of-mouth referrals. Participants want to feel in control without needing a tech background. Make that happen, and you’ve won half the battle.

Best Self-Direction Software for FMS Agencies

If your current platform doesn’t support this kind of experience, our breakdown of the best self-direction software for FMS agencies highlights the features that actually matter to families.

BONUS: Participants Want a Fair (and Clear) Burden Rate

Now let’s talk about money. We make that clear with the "Spending plan tool"

Every hour worked by a caregiver has two prices:

- What the worker is paid, and

- What get's charged to the participant's budget

The difference between those two is called the burden rate. It covers payroll taxes, insurance, and administrative costs. In most programs, this rate lands somewhere between 20% and 30%, but that small margin can feel like a big deal to participants trying to get the most out of their budgets.

Some participants shop around based on this number. And it makes sense—they want their dollars to go as far as possible.

But here’s the thing: a slightly lower burden rate doesn’t always mean better value.

If a participant saves 2% but their worker isn’t covered by workers’ comp, that’s not just risky—it’s potentially devastating. If that same agency also has a confusing app, slow approvals, or poor customer service, that 2% disappears fast in stress and wasted time.

The real goal is balance.

Yes, your burden rate should be competitive. But it should also be transparent. Show how that rate breaks down. Explain what you’re covering. Help participants understand that their workers are getting not just wages, but protections—protections that matter in the long run.

Then, steer the conversation back to where it really belongs:

How easy is it to work with you day to day?

Here's a link to our CA Self-Determination Program (SDP) Spending Plan Calculator

Take This Topic Off the Table

A smart way to address burden rate questions is to bring them up proactively. Don’t wait for someone to ask “Why is your rate 2% higher than XYZ FMS?” Get in front of it:

“Our burden rate includes full payroll taxes, workers’ compensation, and support for compliance with state rules. We also offer a participant app that makes it easy to manage your care. We find that most participants save time, money, and frustration by choosing a provider they can trust—rather than one who cuts corners.”

This kind of messaging takes the edge off the rate conversation. It tells participants, Yes, we care about your budget—but we also care about your experience.

The Bottom Line

People don’t choose an FMS agency just because of numbers. They choose the one that gives them control without overwhelm. That starts with your tech—and continues with how well you explain what’s behind the scenes.

Want participants to choose you? Make it easy. Show them how your app helps them stay on top of their care. Be transparent about your rates. And most importantly, help them feel supported—not buried in paperwork.

That’s how you earn their trust. And that’s why they’ll stick with you.

Self-Directed Medicaid Home Care Services in 2026

For more context on how these programs are expanding and how families are gaining more choices, our overview of self-directed Medicaid home care services in 2026 explains the broader landscape your FMS is competing in.

Ankota's mission is to enable the Heroes who keep older and disabled people living at home to focus on care because we take care of the tech. If you need software for home care, EVV, I/DD Services, Self-Direction FMS, Adult Day Care centers, or Caregiver Recruiting, please Contact Ankota.

.png)

.png)

.png)

.png)